Just Peace Advocates is pleased to work with the Good Shepherd Collective and others in the development of this report.

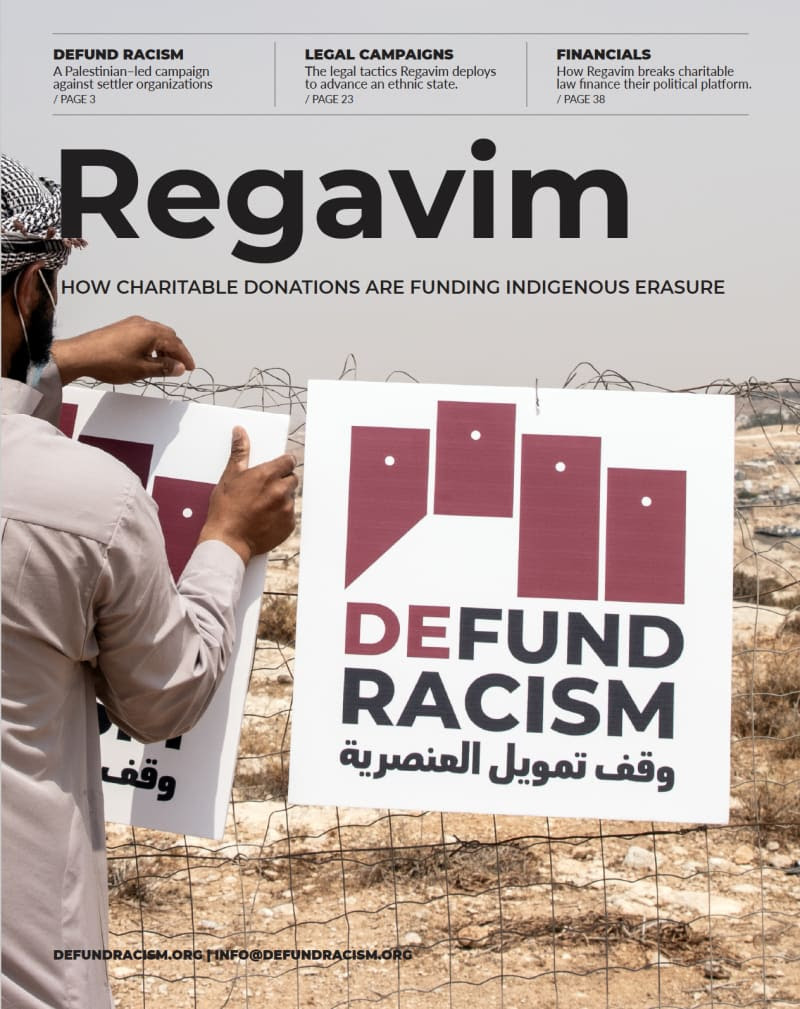

Good Shepherd Collective in partnership with several organizations, including the Youth of Sumud, the Popular Struggle Coordinating Committee, the Hebron Defense Committee, Human Rights Defenders, Jisoor, and Just Peace Advocates/Mouvement Pour Une Paix Juste, has published a detailed 48-page report on the Israeli settler organization Regavim. This organization is at the forefront of efforts to ethnically cleanse and forcibly displace Palestinians. The report delves into Regavim’s fundraising methods, organizational structure, and its strategies to displace Palestinians from their properties and rights. This report provides actionable recommendations for the global community to get involved. Please take a moment to download, read, and share this report within your networks.

Read this critical report on Regavim and the use of charitable donations. Download below or here.

In Canada

Regavim’ s website offers tax receipts to Canadian donors.

In Canada, at least one registered charity has been found to provide tax receipts for funds designated by Canadians to Regavim. Mizrachi Organization of Canada (Canada business number 119043891 RR 0001), a Canadian charity, provides receipts for Regavim according to Jgive website. This has been confirmed in emails from Jgive as well as through obtaining a tax receipt from Mizrachi Organization of Canada through a donation made to Regavim via Jgive.

Previously, as the new report indicates Canada provided money in 2012 through MagbitCanada (United Israel Appeal/UIA) 100,000 NIS, and then through Gates of Mercy in 2014 and 2015, at 512,048 and 459,700 NIS respectively

In Canada

Regavim’ s website offers tax receipts to Canadian donors.

In Canada, at least one registered charity has been found to provide tax receipts for funds designated by Canadians to Regavim. Mizrachi Organization of Canada (Canada business number 119043891 RR 0001), a Canadian charity, provides receipts for Regavim according to Jgive website. This has been confirmed in emails from Jgive as well as through obtaining a tax receipt from Mizrachi Organization of Canada through a donation made to Regavim via Jgive.

Jgive’s parent organization, the Asor Fund – charges a fee per credit card transaction. Asor Funds tax information shows a rapid growth with reported revenue in 2014 (about $33,000 in CDN dollars) in its first year of operation, to in 2021 when the Asor Fund reported over 110 million shekels (about $40 million in CDN dollars) in revenue.

Previously, as the new report indicates Canada provided money in 2012 through MagbitCanada, 100,000 NIS, and then through Gates of Mercy in 2014 and 2015, at 512,048 and 459,700 NIS respectively.

Magbit Canada has a Facebook that provides information about who they are.

Its headquarters are 48 King George St., Jerusalem, Israel, and has a Jerusalem phone number. The two url’s provided are no longer active, magbitcanada.org.il and uiac.org.il. The Facebook page established in 2010, has not been active since around 2014. Ynet referenced Magbit as the representing the Canadian Jewish organizations in reporting on its donations in 2007.

The Jewish Federations of Canada-UIA provides the same address as indicated by Magbit Canada.

The UNITED ISRAEL APPEAL OF CANADA INC, BN/Registration number: 134593391 RR 0001, a Canadian registered charity that provides about $60M annually to Israel, although does not detail the organizations it provides money to on the CRA public listing. In 2022, the United Israel Appeal of Canada, Inc. received $55.9M of funds, with $36M from other charities and $12M for individuals who receipted charity receipts. $55.8M was provided to other countries with $45.7M going to Israel, as well as funding to 17 Canadian based charities some of which appear to provide funds to Israel.

Gates of Mercy who provided funds to Regavim in 2014 and 2015, had its charity status revoked in 2019.

Howe and Sylvestre (2022) a phenomenon referred to as a “burner charity” that sometimes occurs when charities have their registration revoked for non-compliance by the Canada Revenue Agency, whereby the donation pattern to out of country organizations is picked up by a new charity, showing a pattern of relationship between several aligned charities.

One example of a “burner charity” is when Gates of Mercy and Beth Oloth had their charity status revoked, and other charities such as the Jewish Heritage Fund immediately took their place.

Complaints that have been filed call on the Canada Revenue Agency to investigate associated charities as well as the currently identified conduit, Mizarchi Organization of Canada (MOC). MOC is transferring donations to Regavim as well as other Israeli settler or military organizations.

See more.

Webinar

In Canada, registered charities are charitable organizations, public foundations, or private foundations that are created and resident in Canada. They must use their resources for charitable activities and have charitable purposes that fall into one or more of the following categories: the relief of poverty, the advancement of education, the advancement of religion or other purposes that benefit the community. Registration provides charities with exemptions from income tax. Registration also authorizes charities to issue official donation receipts for income tax purposes, allowing donors to claim gifts made to registered charities to reduce their income tax. More information regarding registered charities in Canada can be found here, as information regard to “Canadian registered charities carrying on activities outside Canada, can be found here.

30+ groups tell the Canada Revenue Agency that colonialism is not charity

Foreign “settler colonial NGO”, founded by “proud homophobe”, receiving Canadian subsidies

Canada should remove charitable status from groups funding the Israeli army