The Naksa. June 5, 2021, 54 years of military occupation in the occupied Palestinian and Syrian Golan territories.

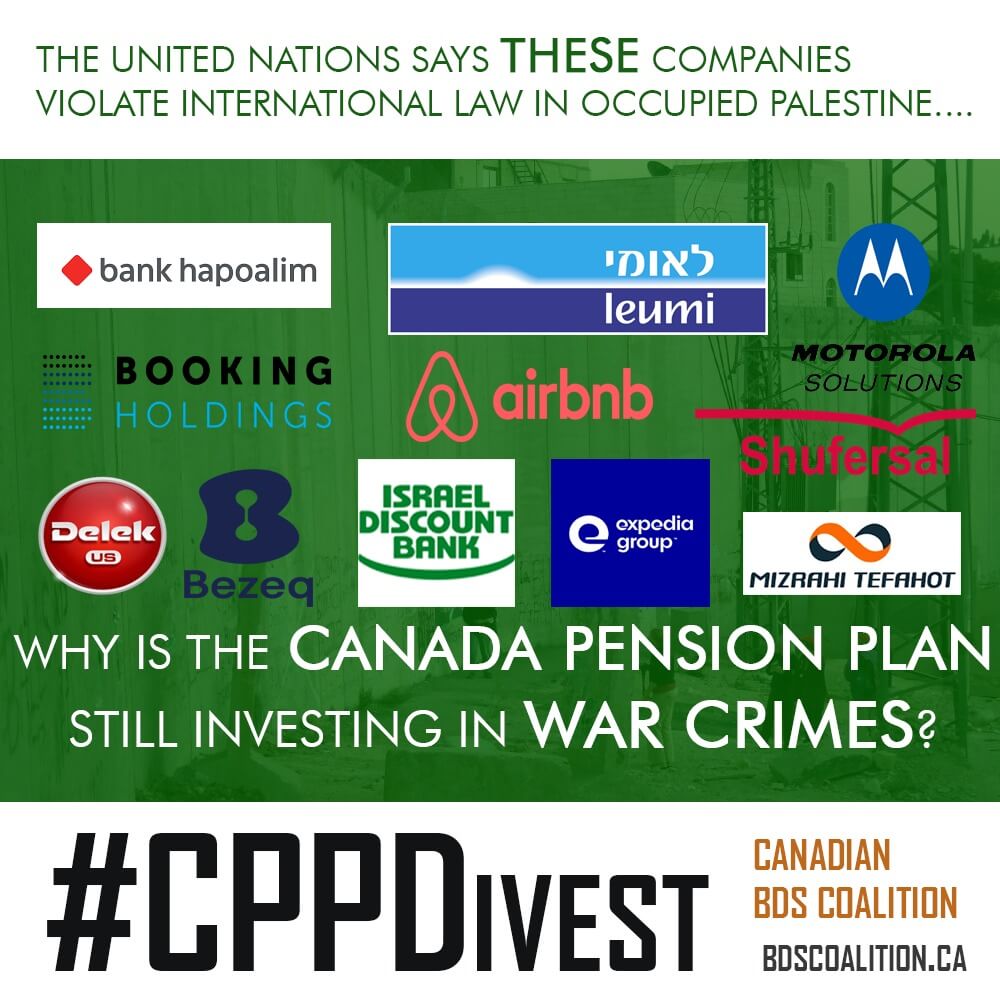

Canada public pension continues to support war crimes in its divestment. Tell CPP to Divest #CPPdivest.

The recent 2021 CPPIB Annual Report while showing that CPPIB has divested from General Mills, indicates increased investments in Israeli war crimes with at least 10 companies identified by the UN as complicit in war crimes.

Read more.

#CPPdivest

CPP INVESTMENTS THAT ARE IN THE UNITED NATIONS DATABASE:

CPPIB 2021 investments in companies listed by the UN as complicit with Israeli war crimes include:

Airbnb Inc. (11 shares, $3M), E, United States

Bank Hapoalim B.M, (693 shares, $7M), E, F, Israel

Bank Leumi Le-Israel B.M, (925 shares, $8M), E, F, Israel

Bezeq, the Israel Telecommunication Corp Ltd. (1541 shares, $2 M), E, G, Israel

Delek Group Ltd – Delek US Holding Inc., (50 shares, $1M), E, G, Israel & USA

Expedia Group Inc., (565 shares, $122 M), E, United States

Israel Discount Bank Ltd., (725 shares, $4 M), E, F, Israel

Mizrahi Tefahot Bank Ltd. (86 shares, $3 M), E, F, Israel

Shufersal Ltd., (137 shares, $1 M), E, G, Israel

Booking Holdings Inc (123 shares, $359 M), E, United States

Motorola Solutions Inc., (27 shares, $3M),B, United States

The CPP investments in the companies listed in the UN Database make up $513 M of $134,226 M of CPP Foreign Publicly-Traded Equity Holdings as of March 31, 2021.

Legend

Human Rights Council resolution 31/36 defined the database by reference to the listed activities compiled by the fact-finding mission in its report, which include:

B: The supply of surveillance and identification equipment for settlements, the wall and checkpoints directly linked with settlements;

E: The provision of services and utilities supporting the maintenance and existence of settlements, including transport

F: Banking and financial operations helping to develop, expand or maintain settlements and their activities, including loans for housing and the development of businesses;

G: The use of natural resources, in particular water and land, for business purposes;

Given that the aggregate investments are a very small proportion of the foreign traded portfolio, it seems it is an easy move for the CPP Investment Board to divest from companies that have been named as complicit in acts contributing to the maintenance of illegal settlements.

THE CPP CANADIAN INVESTMENT PORTFOLIO

Based on our review of the CPP’s Canadian public equity holding, the portfolio is dominated by one company.

This company, WSP Global, is a Canadian management and consulting firm that specializes in engineering projects. This company, according to Who Profits, is involved in the planning of the Israel railway system that crosses into the occupied West Bank and constitutes settlement infrastructure.The CPP investment in WSP Global is at over 21K shares with a market value that increased fromMarch 31, 2020 of $1,683 million, to $2,583 M as of March 31, 2021.

This certainly begs the question as to why the CPP has invested in one firm, WSP, so heavily within in Canadian Publicly Traded equity holding of the CPP in one company; beyond this one that is involved in illegal settlement activities.

There are a number of other companies of concern that can be identified, but given the recent large divestments from public pensions in New Zealand and Norway, join the call for the CPPIB to divest immediately from these United Nation identied companies, and WSP, the Canadian company which has been verified by Who Profits and AFSC.

The Call

1. The CPPIB immediately take steps to diversify the Canadian equity portfolio;

2. To divest from WSP

3. Review the Canadian portfolio for any other companies that are in violation of international law

4. Put in place a transparent process to ensure that companies are vetted for violations of human rights and international law.

The concerns that we raise are in the broader context of ethical investment related to Canada’s public pension fund investment.

We ask the CPPIB to take all steps necessary to ensure that the activities of all companies included in all of its portfolio are in compliance with international law governing war crimes. We remind you that in Canada, parties that are complicit in war crimes are liable to criminal prosecution under the Crimes Against Humanity and War Crimes Act,[1] including corporations.[2]

This is the Second Call on CPPIB

In March 2021, 70+ organizations from across Canada and around the world, and 130+ individuals including former federal members of parliament Libby Davies & Jim Manly, former UN rapporteur John Dugard, Chris Hedges former NY Times bureau chief, academics, faith community leaders, labour leaders & many others demanded that Canada’s public pension divest from companies identified by the UN as supporting Israeli war crimes. Learn more & read list of all signatories. Subsequently, 500+ letters were sent to the Canadian Pension Plan Investment Board (CPPIB).

The United Nations (UN) Database of companies complicit with human rights violations

The UN Database was released on February 12, 2020 in the Report of the United Nations High Commissioner for Human Rights (A/HRC/43/71) after the independent international fact-finding mission to investigate the implications of the Israeli settlements on the civil, political, economic, social and cultural rights of the Palestinian people throughout the oPt, including East Jerusalem. There are a total of 112 companies included on the UN list. Based on CPP’s March 31, 20201 annual listing of equity holding, the CPP is invested in at least ten companies that are listed in the United Nations database.

UN Security Council resolution 2334 (2016) reaffirmed that settlements have no legal validity and constitute a flagrant violation under international law.

Note: information about the companies, verified by Who Profits, an independent Israeli research organization and/or the American Friends Service Committee “Investigate” as per links provided with each of companies listed.

You can review the details associated with each of these companies listed on the United Nations High Commissioner for Human Rights report.

The CPP investments in the companies listed in the UN Database make up $513 M of $134,226 M of CPP Foreign Publicly-Traded Equity Holdings as of March 31, 2021. USA companies, Airbnb and Expedia make up $481M of this investment, with the other nine entities valued at $32 M.

Changes since March 31, 2020, include investment in Airbnb and Delek. There was decrease in shares held and value of Expedia and increase in shares held and value of Booking Holdings and Motorola.

We do consider it a victory that CPPIB has divested from General Mills, eliminating the 324 shares valued at $24 M in the March 2020 report.

Given that the aggregate investments are a very small proportion (less than one-percent) of the foreign traded portfolio, it seems it is an easy move for the CPP Investment Board to divest from companies that have been named as complicit in acts of military occupation and contributing to the maintenance of illegal settlements (aka “war crimes”)

#CPPdivest